The valuation of a Software as a Service (SaaS) business is a complex process involving a multitude of factors. It’s a hot topic for business owners, investors, and buyers, given the unique characteristics and rapid growth of the SaaS industry. This comprehensive guide aims to demystify the process of SaaS valuation, diving deep into the key metrics and considerations that underpin an accurate SaaS company valuation.

Understanding SaaS Valuation

At its core, a SaaS business valuation is a method used by investors and business owners to determine the economic worth of a company. However, quantifying a company’s value, particularly in the dynamic SaaS sector, can be intricate. Each valuation is influenced by factors such as the industry landscape, the business model, the value proposition, and many more.

There’s no one-size-fits-all approach to determining a company’s value. Instead, a combination of methods is employed to gauge the final value. By comprehending the key drivers and attributes of SaaS valuation, you can ensure that you’re neither underselling nor overestimating your company’s worth.

| Startup Stage | ARR/MRR (in $) | Valuation Range | Revenue Multiple | SDE Multiple | EBITDA Multiple |

|---|---|---|---|---|---|

| Seed Stage | < 1M | 1M – 5M | 1x – 3x | – | – |

| 1M – 2M | 5M – 10M | 2x – 4x | – | – | |

| 2M – 5M | 10M – 25M | 3x – 6x | – | – | |

| 5M – 10M | 25M – 50M | 4x – 8x | – | – | |

| Early Stage | 10M – 25M | 50M – 100M | 5x – 10x | 2x – 4x | – |

| 25M – 50M | 100M – 200M | 6x – 12x | 3x – 6x | – | |

| 50M – 100M | 200M – 500M | 7x – 14x | 4x – 8x | – | |

| Growth Stage | 100M – 250M | 500M – 1B | 8x – 16x | 5x – 10x | 10x – 20x |

| 250M – 500M | 1B – 2B | 10x – 20x | 6x – 12x | 12x – 24x | |

| 500M – 1B | 2B – 5B | 12x – 24x | 8x – 16x | 15x – 30x | |

| Late Stage | > 1B | > 5B | 15x+ | 10x+ | 20x+ |

Key Attributes of SaaS Company Value

When it comes to valuing B2B SaaS companies, investors and owners consider different company attributes and qualities than for non-SaaS businesses.

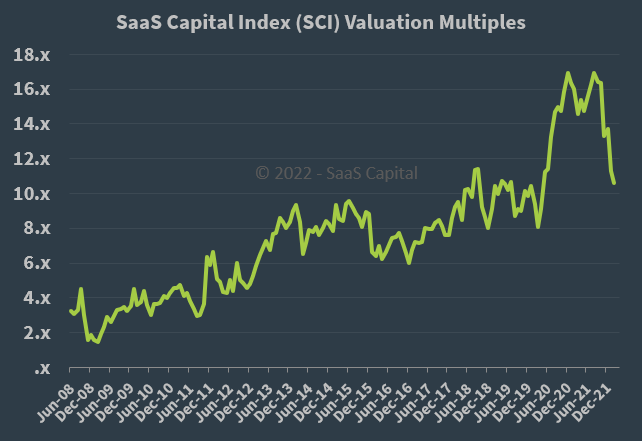

According to Saas Capital In 2021, the median SaaS valuation multiple for public companies fell from its 2020 peak, a record-high of 16.9x ARR, down to 10.7x ARR by February 2022.

Conversely, the multiple for private B2B SaaS companies, which did not experience the same surge, remained relatively stable, hovering between 5x to 8x ARR, as they have in recent years.

B2B SaaS companies differ from traditional businesses in several ways:

- High volumes of recurring revenue, as opposed to one-time purchases

- High gross margins as cost-to-service decreases over time

- Renewal rates, which are a key driver of long-term success

- Improvements in customer service levels as customers continue to pay

Furthermore, as software companies aren’t constrained by physical supply chains like manufacturers or retailers, B2B SaaS companies don’t face issues such as forecasting shortages, limited production volumes, or a lack of supplier diversity.

Valuation Methods for SaaS Companies

There are three primary ways to value a SaaS company by examining its earnings: Seller Discretionary Earnings (SDE), Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), and Revenue-based valuation (ARR Multiples).

Revenue-based Valuation (ARR Multiples)

The first method of valuing a software business is through Annual Recurring Revenue (ARR). ARR buyers are willing to pay multiples of ARR as they appreciate the value of recurring revenue, leading to an increasing number of private equity firms favoring this category of valuations.

A revenue-based valuation is optimal if your SaaS company has just achieved product-market fit (PMF), you’re driving T2D3 growth, or you’ve earned $1 to $100 million ARR. To achieve a valuation based on a revenue multiple, you need an ARR greater than $2 million and Year Over Year (YOY) growth rates over 50%.

SDE-based Valuation

Seller Discretionary Earnings (SDE) is the residual value after the owner has paid all expenses (including payroll, overhead, and tools) and added their salary back into the business to demonstrate its earning power.

SDE is calculated as follows:

Revenue – Cost of Goods Sold – Operating Expenses + Owner Compensation

For businesses with a sole owner or under $5 million in ARR, valuation through SDE makes the most sense.

EBITDA-based Valuation

If your software company has reached the rule of 40 or you have a generally low customer acquisition cost (CAC), an EBITDA Valuation may be beneficial. For SaaS buyers looking at an EBITDA Valuation, they’re deriving value from the company’s ability to deliver a strong cash flow.

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is beneficial for companies with high profits.

To calculate your SaaS company’s EBITDA, use the following equation:

Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA valuation is often used for a company with earning power above $5 million ARR.

Determining Your SaaS Valuation Multiplier

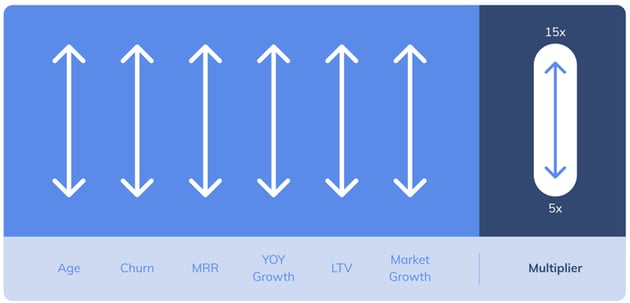

21st-century companies are typically valued by multiple to reflect the true, long-term value of a business. The more established the business is (or the more a business depends on larger and longer-term contracts) the bigger the multiplier.

B2B software companies can be valued from anywhere between 3x and 15x their annual revenue — determined by a mixture of parameters, who is conducting the valuation, and other valuations within the industry at the same time.

In a business valuation for software companies, the listing price is:

Average net profit for the last year x multiple

As a general rule of thumb, the B2B SaaS valuation spectrum looks something like this:

But how can you determine what your SaaS multiple is? While some of the influential factors may be out of your control, here are some valuation attributes to focus on:

- Revenue (ARR or MRR)

- Churn and renewal rates

Revenue Size (ARR and MRR)

You want strong, reliable revenue with strong cash flow, and are typically categorized into the following segments:

- $1 – $2 million. This is below the size most Private Equity and SaaS buyers will consider. However, your SaaS buyers will be very strategic, searching for a specific functional fit.

- $5 million. At this point, you’ve displayed product-market fit (PMF) and you’ve started to scale. The next steps for growth could be a product or geographical expansion. Smaller SaaS companies that hit $5 million in ARR are more attractive to investors and buyers due to the scale. Multiples here will be higher than $1 million, but not as high as $10 million.

- $10 million. At this stage in growth, this puts you on the map for most SaaS buyers. Investors at this point are much more likely to offer multiples ranging in the 10x/15x range, depending on market size and growth opportunities.

- $100 million. At $100 million ARR, you’ve reached the ‘profit’ stage of T2D3 growth. Private Equity firms and SaaS buyers are most likely to see multiples in the double-digits.

Note that there are two types of revenue in a SaaS valuation. Non-Recurring, like professional services, onboarding/setup fees, or migration charges, and Recurring Revenue, usually described as either monthly recurring revenue (MRR) or annual recurring revenue (ARR).

Investors typically like to see MRR over ARR because monthly revenue is more reliable. To make your software company’s valuation increase when you’re ready to exit, focus on increasing MRR over ARR.

Churn and Renewal Rates

A B2B SaaS company’s churn rate, or rate of lost customers, can be broken down by month or year. We recommend matching your metrics for revenue and churn to be either monthly or annually. Still, it’s important to note that ‘acceptable’ churn rates vary depending on your customer base and market. We break these up into three categories: SMB, MidMarket, and Enterprise.

Customer churn rates may range between 5-7% annually for a healthy valuation. This means that around 5 out of every 100 customers leave.

For a SaaS business that services SMEs, your churn rates can be a bit higher, given the number of small businesses that fail every year. However, for SaaS businesses targeting enterprise customers, you should have a churn rate of 10% or less.

On the other hand, churn can be measured by your company’s renewal rate. Because a SaaS company relies primarily on subscription-based revenue, the customer will likely turn into a renewing customer. Renewal rates over 90% are healthy and positive. However, churn is a more popular metric as it often is paired with automatic renewals (leading to a better valuation).

Other Factors Influencing SaaS Valuation

While the quantitative analysis tools discussed above provide a concrete basis for evaluation, there are also other, more nuanced, factors that influence SaaS valuation. These include:

- Gross Margins

- Scalability (adding revenue faster vs. growing the cost to service)

- YOY growth rate

- TAM, SAM, and SOM

- Age of the company

- Owner involvement

- Diversity

- Value proposition

- Marketing foundation

- Company assets

- Market valuations

Let’s delve into these factors further.

Gross Margins

A company’s gross margin is the net sales revenue minus its cost of goods sold. In simple terms, it’s the savings on each dollar of sales that can be allocated toward other investments (or debt). This ideally should be 80% or more.

Scalability

The potential for your company to grow in size, speed, and cost-efficiency is known as scalability. Consider how large the company can grow, how quickly, and how expensive that will be. For instance, a company with $10 million in revenue could mean larger acquisitions, while a company that hits $50 million could potentially be ready for an initial public offering (IPO).

Year Over Year (YOY) Growth Rates

This metric measures the percentage change during the past 12 months. By evaluating a company’s financial progress over time, you can compare metrics like revenue or gross margin to monitor how your short-term goals are leading toward long-term success.

Most SaaS buyers like to see a growth rate between 10% and 20%, and shy away from YOY growth over 40%. For companies experiencing 50% to 100% YOY growth, this may be a red flag and can scare investors away.

Total Addressable Market (TAM)

Consider the growth opportunities both horizontally and vertically. Some SaaS companies have a limited TAM, so look for a broad buyer universe with multiple sectors to address. $100 million TAM is small, and a TAM closer to $1 billion is a positive signal to your SaaS investors.

Increasing Your SaaS Valuation Multiplier

Now that you’re familiar with the fundamental valuation models, let’s explore how to identify your SaaS valuation multiplier.

21st-century companies are typically valued by a multiple to reflect the true, long-term value of a business. The more established the business is, or the more a business depends on larger and longer-term contracts, the bigger the multiplier.

In a business valuation for software companies, the listing price is:

Average net profit for the last year x multiple

But how can you determine what your SaaS multiple is? While some of the influential factors may be out of your control, here are some valuation attributes to focus on:

- Revenue (ARR or MRR)

- Churn and renewal rates

Let’s break these down further.

Revenue Size (ARR and MRR)

You want strong, reliable revenue with strong cash flow, and are typically categorized into the following segments:

- $1 – $2 million. This is below the size most Private Equity and SaaS buyers will consider. However, your SaaS buyers will be very strategic, searching for a specific functional fit.

- $5 million. At this point, you’ve displayed product-market fit (PMF) and you’ve started to scale. The next steps for growth could be a product or geographical expansion. Smaller SaaS companies that hit $5 million in ARR are more attractive to investors and buyers due to the scale. Multiples here will be higher than $1 million, but not as high as $10 million.

- $10 million. At this stage in growth, this puts you on the map for most SaaS buyers. Investors at this point are much more likely to offer multiples ranging in the 10x/15x range, depending on market size and growth opportunities.

- $100 million. At $100 million ARR, you’ve reached the ‘profit’ stage of T2D3 growth. Private Equity firms and SaaS buyers are most likely to see multiples in the double-digits.

Churn and Renewal Rates

A B2B SaaS company’s churn rate, or rate of lost customers, can be broken down by month or year. We recommend matching your metrics for revenue and churn to be either monthly or annually. Still, it’s important to note that ‘acceptable’ churn rates vary depending on your customer base and market. We break these up into three categories: SMB, MidMarket, and Enterprise.

Conclusion

Understanding how SaaS valuation works is a crucial aspect of owning, buying, or investing in a SaaS business. It’s a complex process involving multiple metrics and considerations but can be made more approachable with a solid understanding of the key factors and drivers involved. By leveraging the insights and tools provided in this guide, you can navigate the SaaS valuation process with confidence, ensuring you neither undersell nor overestimate your company’s worth.

I must give credit to some great resources I use to write this article:

Some More Academic Resources that will help you: